In Sage X3, outgoing payments need to be applied against the relevant invoices to properly reflect the amounts payable to vendors or suppliers in general and on specific invoices.

With the example of the company about to go public, the unapplied payments were found to exist in the subledgers and needed to be applied to produce an easier to follow aging report that showed the accuracy in payment application and outstanding amounts with respect to business partners.

With the application of payments to supplier BP invoices it is important to note the three main areas of the process below:

- Enter payments – original entry screen after definition of entry

- Generate journals by payment – posting payments to the GL and viewing journals

- View posting stages – understand next steps in the process

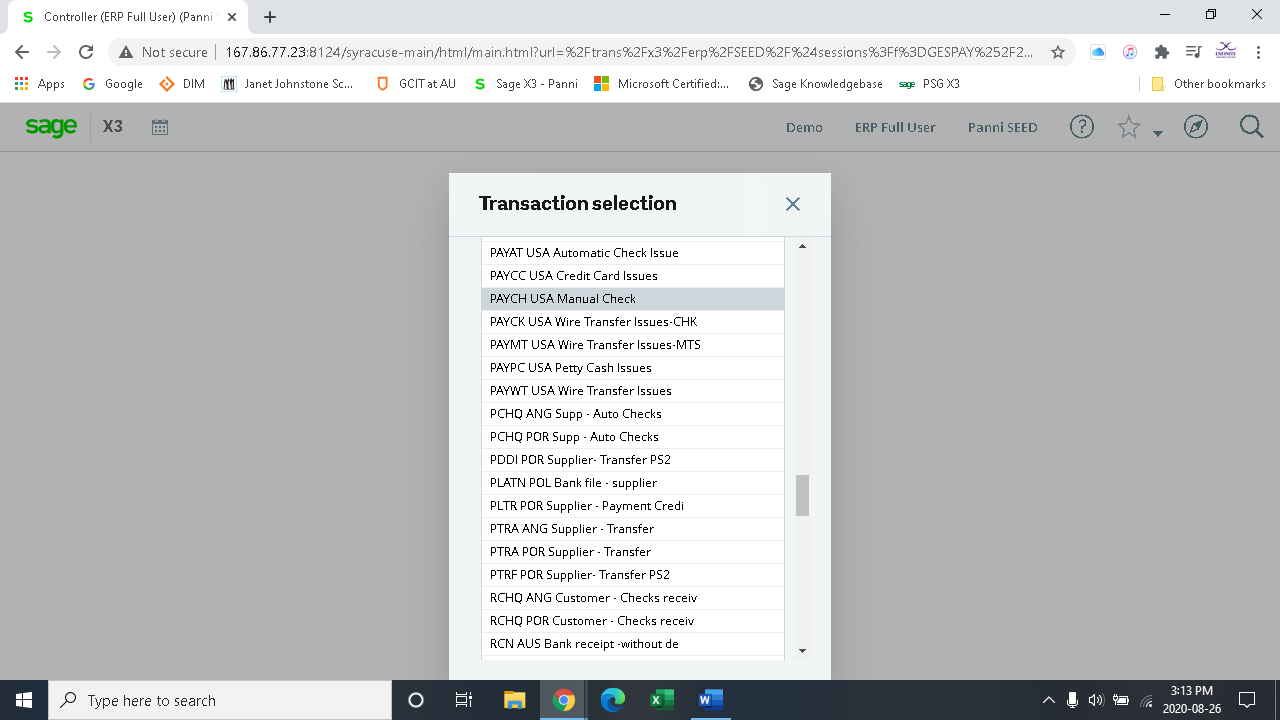

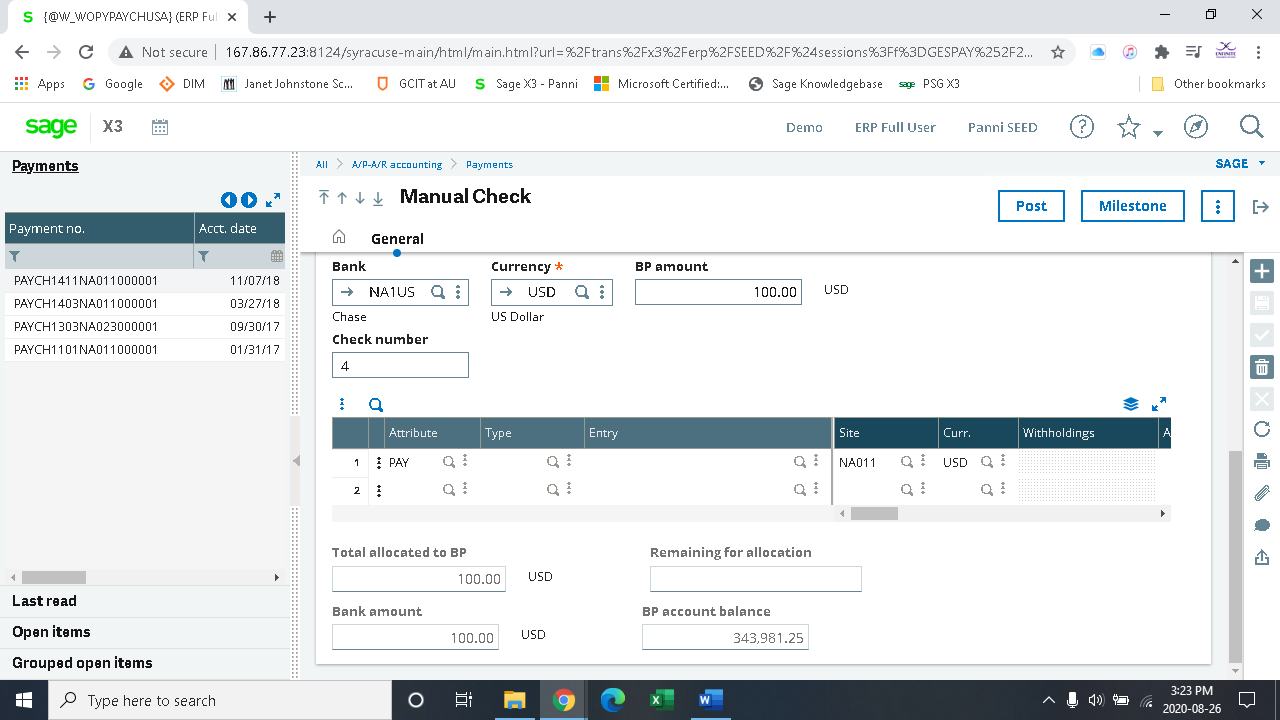

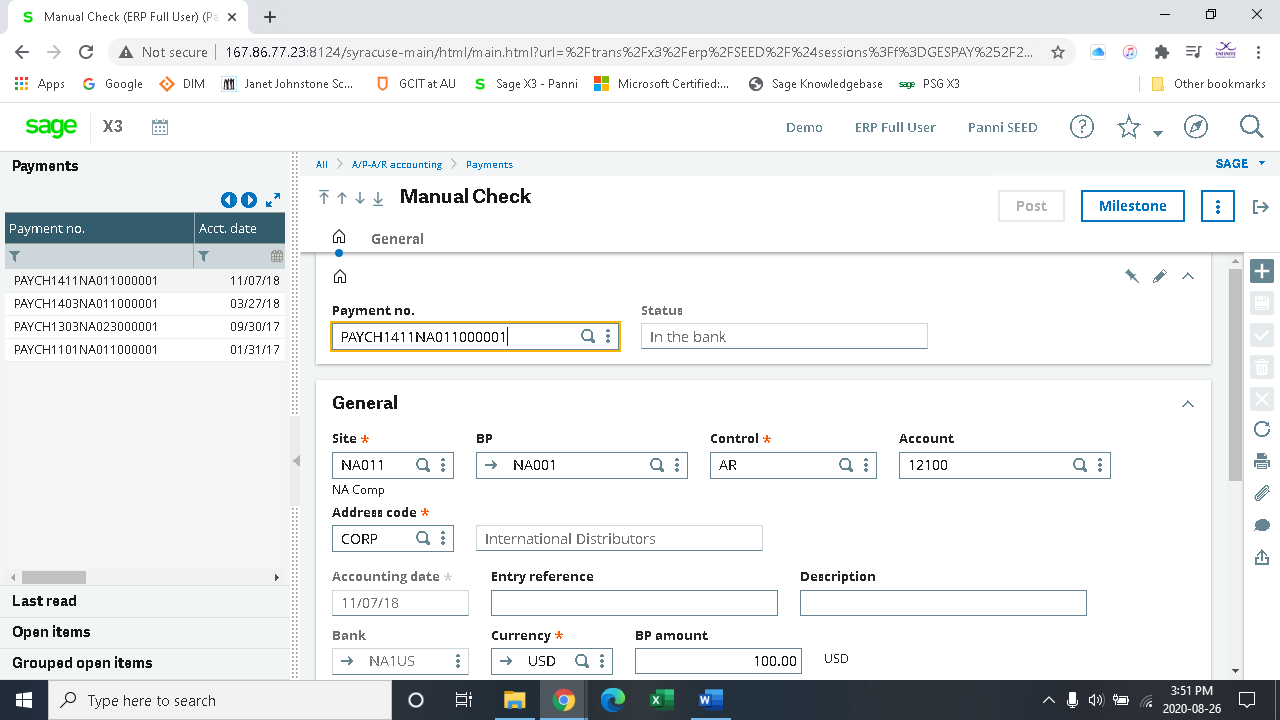

To begin, the user must locate or enter the payment that is desired for application against the supplier BP invoice. In this case the payment will be entered and will be a manual check. Following the path:

All > AP – AR accounting > Payments > Payment/receipt entry

The user must select from the array of payment options that denote the method of choice with respect to the outgoing payment.

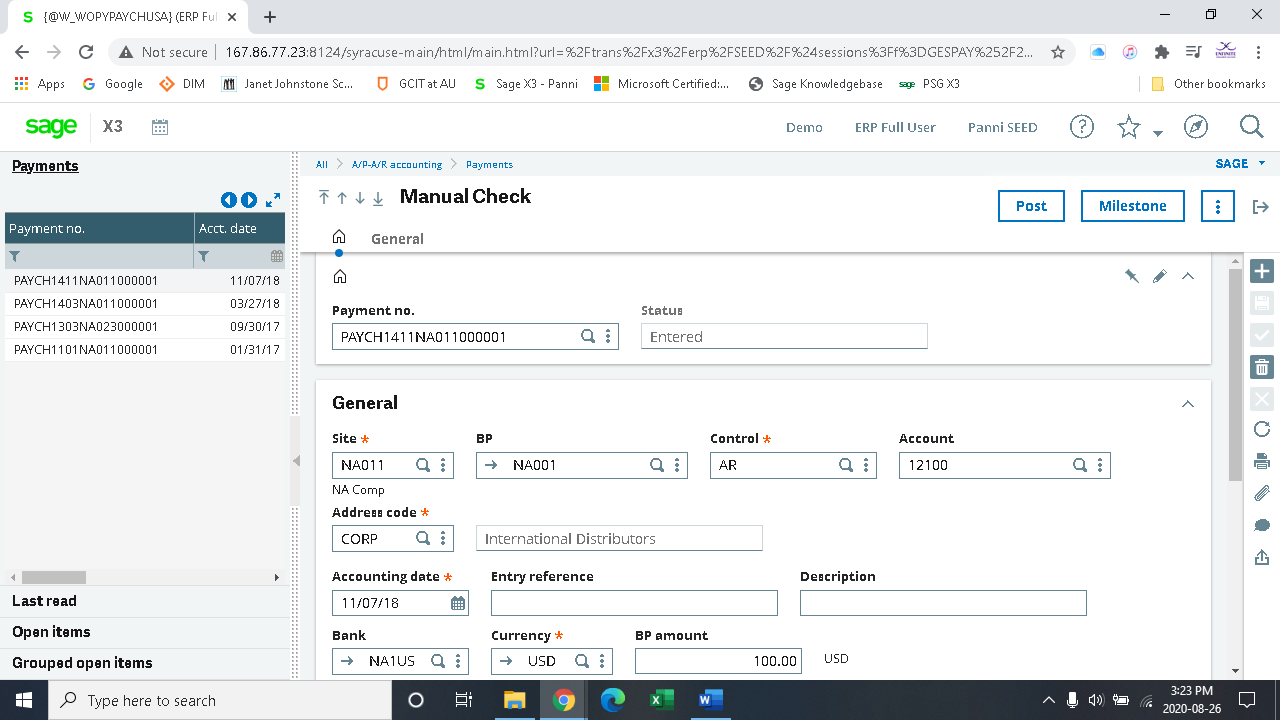

Fields with denoted with the red asterisk (*) must have values to satisfy the creation of manual payment entries

The user must click the plus (+) symbol to denote a new manual cheque. The site and business partner are entered. The control account defaults based on the accounting codes in the set up of the business partner. The address code notes the address of the business partner whether it is a corporate address or another address.

Important to note that the payment number is grey and is only generated on creation of the cheque.

The accounting date is a key field that states when the payment will be posted to the general ledger.

The entry reference and description are free-form fields for details and descriptions that state the purpose of the payment.

The bank field denotes the bank account the funds were drawn from.

The currency will default but can be modified.

The amount of the payment is then entered along with the cheque number.

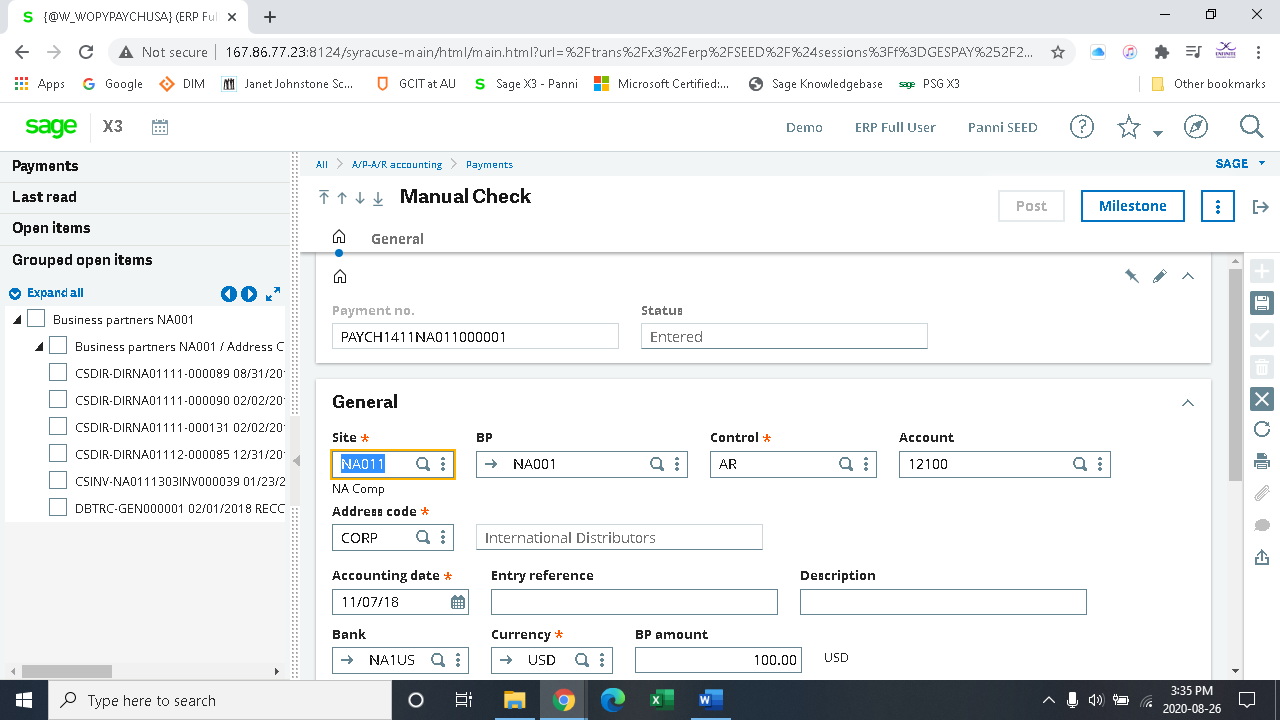

Open items is selected from the left-hand side of the active screen and the payment is then linked to the invoice that receives the payment based on the BP as entered.

The user will then select create (√) and the payment is in the system.

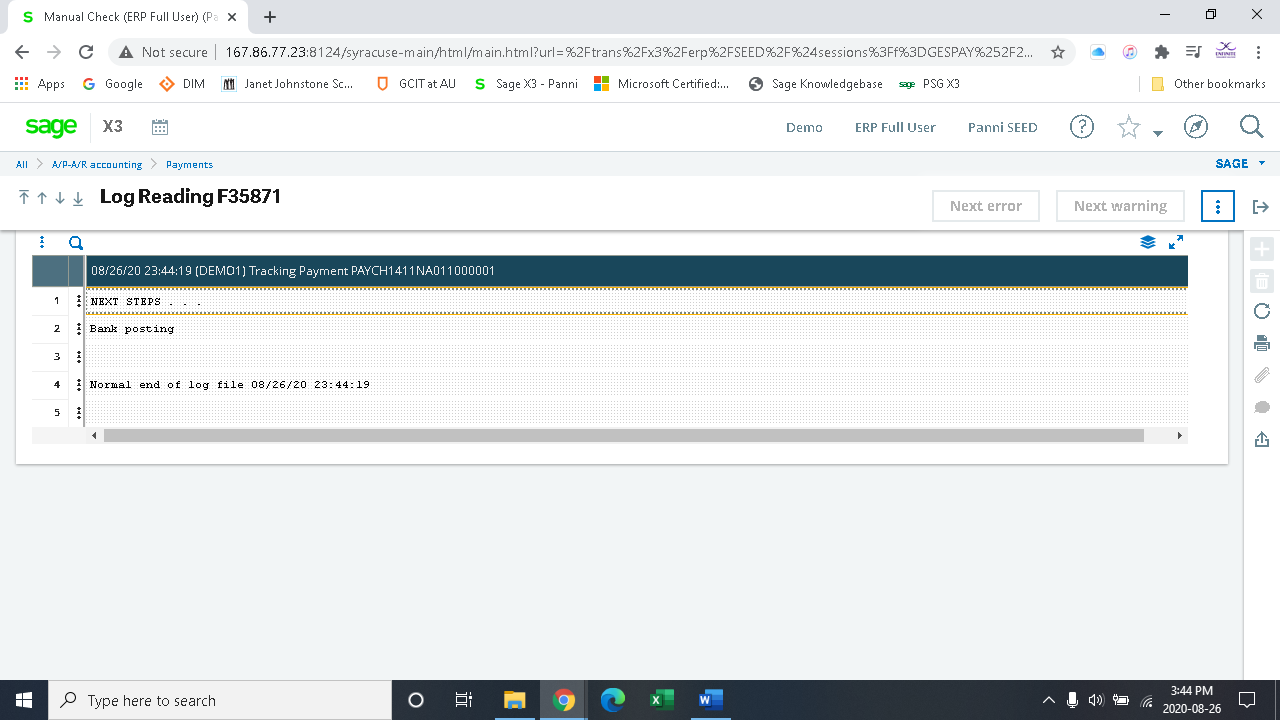

To discover the next steps in the process the menu button marked milestone may be selected for more information and to progress with the application of payments.

The next step in the process of manual payments is to post to the bank. The screen below shows the display of the milestone function.

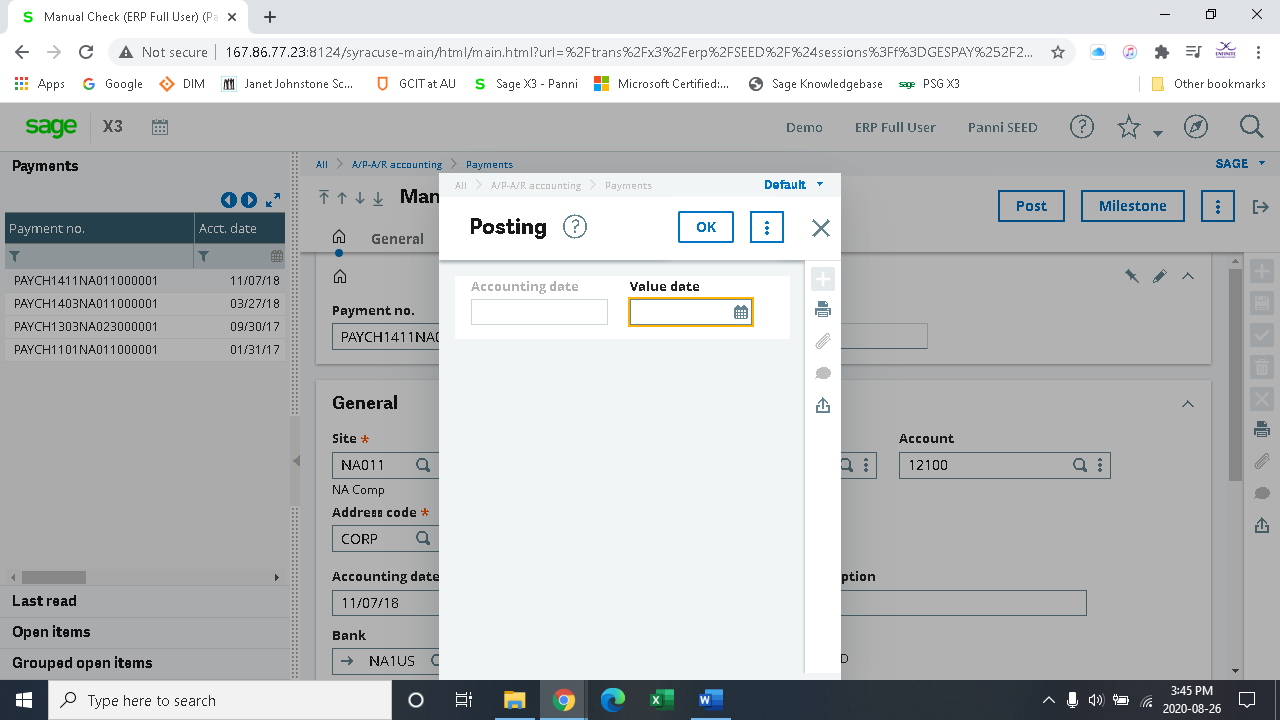

The user may then post the transaction directly from the manual cheque screen and complete the transaction with the posting to the bank. The accounting date may be chosen as the default or the value date (external bank posting date) may be entered. If nothing is chosen in the date field, the date will default to the accounting date.

Once posted the accounting transaction may be reviewed by selecting the menu button on the top right-hand side of the active screen denoted by the three vertical dots and choosing the zoom function and the accounting document to view the journal.

The status can then be viewed as seen below showing that the payment is in the bank.

About the author

James Hurren is a Senior Financial Consultant at Panni. He brings with him expertise in ERP design and implementation, IT Initiatives and enhancements, Strategic Leadership, Financial Reporting & Analysis, IFRS & TSX Compliance, Debt and Equity Financing, Budget Preparation Process Optimization.

Transforming Businesses since 2009

For over a decade, Panni has helped companies transform their businesses to lead, innovate and be profitable. With the right combination of technology and experienced developers and consultants, we help companies with Change Management to achieve the organizational objectives. We believe in long-term relationships with our clients and provide top-notch support with fast turnaround times.